In today's unpredictable world, where uncertainties abound, it is essential to safeguard ourselves and our loved ones from various risks that may crop up in our life's journey. One such way to ensure protection and security is by unleashing the power of Blessing Insurance. Blessing Insurance is more than just a conventional insurance policy; it offers a holistic approach to safeguarding your physical, emotional, and financial well-being. In this article, we will explore the concept of blessings, the significance of Blessing Insurance, and how it can provide an added layer of protection to your life's journey.

Understanding Blessings: Unlocking the Potential

What are Blessings?

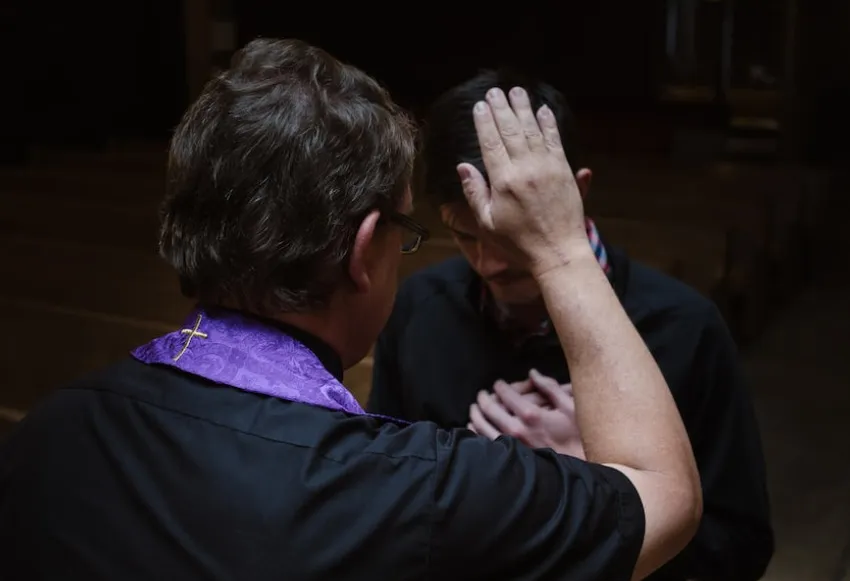

Blessings have long been considered as divine or supernatural assistance, protection, and favor bestowed upon individuals or groups. The idea of blessings transcends religious beliefs and cultural practices and is rooted in the belief that there are forces beyond our comprehension that can influence the course of events in our lives. Whether it is the "lucky charm" we carry, the prayers we offer, or the positive energy we attract, blessings have a profound impact on our well-being.

The Power of Blessings: A Life-Changing Perspective

Blessings are not merely symbolic gestures or wishful thinking; they possess an inherent power that can shape our reality. The power of blessings lies in the positive energy and intention behind them. When we acknowledge and embrace blessings in our lives, we open ourselves up to the possibility of attracting abundance, happiness, and protection. It is this power that makes blessings a significant force in our existence.

The Science behind Blessings: Unveiling the Mysteries

While the concept of blessings may seem mystical or spiritual, scientific research also sheds light on their effectiveness. Studies have shown that a positive mindset and an attitude of gratitude can have a profound impact on our overall well-being. By fostering an optimistic outlook and acknowledging the blessings in our lives, we can experience reduced stress levels, improved mental health, and increased resilience in the face of adversity.

Blessing Insurance: A Comprehensive Approach to Protection

What is Blessing Insurance?

Blessing Insurance goes beyond traditional insurance policies by offering a comprehensive approach to protection. It encompasses various aspects of life, including physical, emotional, and financial well-being. Blessing Insurance acts as an additional layer of security, providing you with peace of mind and a sense of assurance that you are prepared for life's challenges.

The Benefits of Blessing Insurance

-

Physical Protection: Blessing Insurance offers coverage against accidents, illnesses, and unforeseen circumstances that may cause harm to your physical well-being. It provides financial support for medical expenses, rehabilitation, and disability-related costs.

-

Emotional Support: Life's journey is often filled with emotional highs and lows. Blessing Insurance provides emotional support and guidance during challenging times, offering counseling services, therapy sessions, and access to helplines for emotional well-being.

-

Financial Security: Blessing Insurance safeguards your financial stability by providing coverage for loss of income, unexpected expenses, and unforeseen emergencies. It ensures that you and your loved ones are financially protected and can maintain a comfortable lifestyle even during challenging times.

-

Holistic Well-being: Blessing Insurance takes into account the interconnectedness of various areas of life. It offers holistic well-being benefits such as wellness programs, lifestyle management services, and access to alternative therapies. This ensures that you can lead a balanced and fulfilling life, embracing physical, emotional, and spiritual aspects.

How Blessing Insurance Works

Blessing Insurance operates on the principle of proactive risk management. It involves a thorough assessment of your needs and priorities, followed by the customization of a comprehensive insurance plan tailored specifically to you. This includes determining the coverage amount, policy duration, and the types of risks you wish to protect against. Additionally, Blessing Insurance providers offer ongoing support and guidance, ensuring that your insurance plan adapts to your evolving needs.

Unleashing the Power of Blessing Insurance: Real-Life Examples

Case Study 1: Janet's Journey to Recovery

Janet, a vibrant and adventurous individual, met with a severe accident that left her with multiple fractures and in need of long-term medical care. Fortunately, she had Blessing Insurance, which provided financial coverage for her medical expenses, rehabilitation, and home nursing. Through the emotional support offered by the insurance provider, Janet also received counseling sessions to help her cope with the trauma associated with her accident. Within a year, Janet made a remarkable recovery, thanks to the comprehensive protection and support provided by Blessing Insurance.

Case Study 2: David's Financial Safety Net

David, a self-employed professional, experienced a sudden loss of income due to economic upheaval. With the financial security provided by Blessing Insurance, he was able to navigate through this challenging phase without compromising his lifestyle. The insurance plan ensured that David's financial needs were met until he could stabilize his income. It also offered him access to financial planning services, enabling him to make informed decisions and secure his financial future.

Case Study 3: Elena's Holistic Well-being

Elena, a busy executive, found herself struggling to maintain a work-life balance and experiencing high levels of stress. Blessing Insurance recognized the importance of holistic well-being and provided Elena with access to wellness programs, stress management workshops, and personal coaching sessions. As a result, Elena was able to take control of her life, prioritize self-care, and find a balance between her personal and professional spheres.

Choosing the Right Blessing Insurance Provider

When it comes to choosing the right Blessing Insurance provider, several factors should be considered:

-

Reputation and Expertise: Look for insurance providers with a strong reputation in the industry and a proven track record of customer satisfaction. It is essential to choose a provider who understands the dynamics of Blessing Insurance and can offer tailored solutions to meet your specific needs.

-

Coverage and Flexibility: Assess the range of protection and coverage offered by the insurance provider. Ensure that the policy is flexible, allowing you to customize it according to your requirements.

-

Customer Support: Evaluate the level of customer support offered by the insurance provider. Choose a company that provides prompt and efficient assistance, whether it is in terms of claims processing, policy modifications, or general inquiries.

-

Value for Money: Consider the affordability of the insurance plan in relation to the benefits offered. Compare different providers and their offerings to find the best value for your investment.

Conclusion

Blessing Insurance is not just another insurance policy; it is a comprehensive approach to protection and well-being. By acknowledging the power of blessings and embracing the concept of holistic insurance, you can unleash the potential to safeguard your life's journey. Whether it is physical protection, emotional support, or financial security, Blessing Insurance offers the peace of mind you need to navigate through life's uncertainties. Choose the right Blessing Insurance provider and take charge of your future – because your journey deserves the best protection.